Seriously. National Prohibition was the culmination of some eighty years of state and local prohibitions. Its “failure” discredited alcohol prohibition so badly that almost all states discarded it quickly. Countywide prohibition still exists in some of the Deep South (though not in any major cities, as far as I know), and many small townships are still dry, but drinkers today are rarely unable to obtain a legal drink, and that’s been the case for decades.

A few years before Prohibition went into effect under the Eighteenth Amendment in 1920, about 32 states had gone dry and 15 had “local option” prohibition (which was basically a way to encourage and hasten county-level prohibitions). The local option movement in particular had been very successful; about two-thirds of the states had local option by 1913. (After 1913 about half of the local option states went all in for state prohibition, likely in connection with the Anti-Saloon League’s drive for national prohibition. But even before that big drive, there were about 10 dry states and 30 local option states in 1910.) Few of the state prohibitions imposed in the forty years before Prohibition were repealed — that is, not until national Prohibition was repealed. It’s entirely possible that many of those states would have stayed dry for a long, long time, maybe even to this day, if the prohibitionists had quit while they were ahead instead of trying to impose prohibition everywhere.

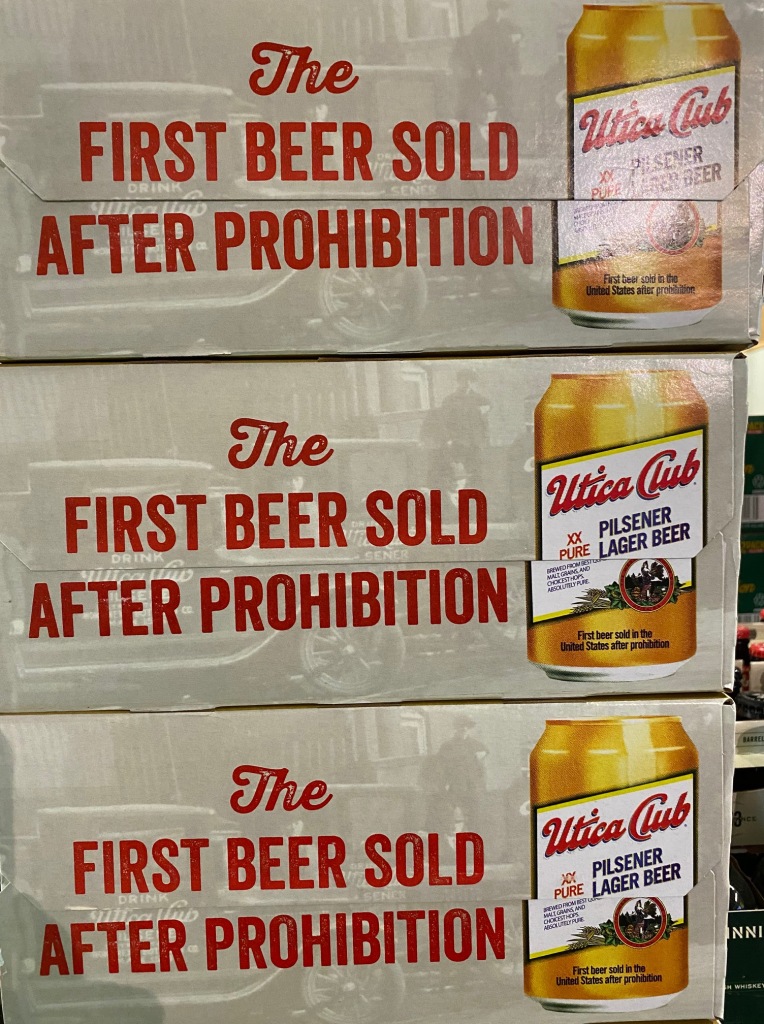

Yet nearly all of those historically dry states gave up the ghost on prohibition shortly after national Repeal in 1933. Only a handful of states, if I recall correctly, kept their statewide bans through 1940. The last holdout was Mississippi in 1966. My point — and I do have one! — is that the apparent abject failure of national Prohibition probably discouraged many temperance-minded politicians and electorates from holding onto prohibition at the state or local level.

Are you saying Prohibition wasn’t an abject failure? You’re not saying it was a success, are you? No, but it was a qualified failure, not a complete failure. (This is the general consensus among historians, by the way. Jack S. Blocker, Jr.’s article “Did Prohibition Really Work?” is a good place to go for the details.) Alcohol consumption did fall during Prohibition; according to careful estimates by economists Jeffrey Miron and Jeffrey Zwiebel, who are anything but pro-Prohibition, alcohol consumption fell about 70% early on and regained only about half of that decline in later years. Prohibition seemed to work well enough in rural areas, small towns, socially conservative areas, and generally where there was widespread support for it. Which was a lot of the nation, especially acreage-wise. (This is kind of like those red-vs-blue county-level maps of support for Republicans vs. Democrats in presidential elections.) Prohibition failed in the cities, where drinking was more popular than temperance. It failed spectacularly in New York City and Chicago, the nation’s two largest cities at the time. Press coverage of speakeasies, flappers, Al Capone, and general flouting of Prohibition in the nation’s two largest media markets would tend to give a skewed impression of how Prohibition was faring nationally. “Prohibition was a failure” became such strong conventional wisdom that virtually nobody thinks of bringing it back. Even some of those few dry holdout towns, like the ones I’ve working on a paper on (Kensington, Takoma Park, and Damascus, Maryland), have jumped on the wet wagon.

We can also thank Prohibition for the death of the old all-male saloon, which gave way to the fuller inclusion of women in our drinking places and rituals. (See Catherine Gilbert Murdock’s excellent book “Domesticating Drink” for a fuller account.) Prohibition spawned countless new cocktails, as spirits, being much more easily concealed than beer, soared to new heights of popularity. While Prohibition’s unintended legacy isn’t all positive — for example, it made American beer even blander and more homogenous (I have a paper on this that I can send you) — the perception that it failed outright arguably means that the overwhelming majority of American drinkers can get a drink wherever they want. Speaking of which . . .